Taking stock of online brokerages

By DIAN VUJOVICH

Special to the Palm Beach Daily News

Saturday, August 22, 2009

Recently I received a letter from E*Trade stating it was going to charge me $2 every time a statement was sent to me via snail-mail. So I started sniffing around to see what was happening at other online brokerage firms.

What I learned: not all online discount brokerage firms are the same, costs can vary from one to another, and some are best suited for active traders -- and others are not.

Recently I received a letter from E*Trade stating it was going to charge me $2 every time a statement was sent to me via snail-mail. So I started sniffing around to see what was happening at other online brokerage firms.

What I learned: not all online discount brokerage firms are the same, costs can vary from one to another, and some are best suited for active traders -- and others are not.

And that my account was with the wrong company. But more on that later.

One fact stood out: online trading doesn't appeal to everyone. One local I spoke with doesn't participate because of distrust for the system. Another doesn't like trading without a broker's advice. A third doesn't trade often and saw no use for using one.

I was surprised. I had thought online trading was really in. Turns out, that's not the case.

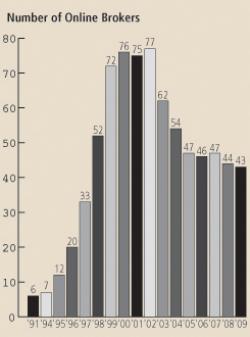

Cara Scatizzi, an associate financial analyst at the American Association of Individual Investors, says the number of online brokerage firms peaked in 2002 when there were 77. Since then, this Chicago-based company's survey show the number is down substantially. In 2008, for instance, there were 44 online brokerage firms; this year, 43.

If you're considering opening an online trading account, or moving from one to another, Scatizzi suggests some research. "The first thing, obviously, is to check their fees like how much it's going to cost you to trade or open the account. You might be thinking that you're going to save yourself a lot of money and then find out that you're not."

Also, find out what commission costs on trades other than market order ones would be, how quickly trades are executed, and what kind of product research the firm offers. "Not all online brokerages offer analysts reports, for instance," says Scatizzi, who also is an editor of AAII's Computerized Investing.

According to AAII's research, the three reasons investors use online brokers are commissions, the services available and convenience. The five most popular online brokers, in order of popularity, are Scottrade, TD Ameritrade, Charles Schwab, Fidelity and E*Trade.

I telephoned each and asked if there is a charge for mailing statements, a fee to have a check from my account mailed to me, fees for transferring an account from one online broker to another, how much money is required to open an account and what commission charges on market orders would be.

For what I learned based on opening a new account whose owner planned on placing simple market orders, see the box at right.

With all these firms, the more money in your account and the more actively you trade, the more fees can be waived or adjusted. Also, all commissions quoted are not round-trip but one-way. Example, $12.99 for selling a stock, $12.99 for buying one.

Another important note: If you consider moving from one online brokerage firm to another, keep records of all previous buying and selling. Firms don't transfer cost-basis information, so it's up to you to keep track of those details. Eventually they'll be necessary to keep you, Uncle Sam and your accountant happy.

So thanks to that snail-mail fee notice I received, I'll be moving my account. But who knew there were so many things to consider with respect to a simple individual, non-retirement online brokerage account.

-- AAII compares online firms at www.aaii.org.

Survey of online brokers

Scottrade

(800) 619-7283

- It takes $500 to open an account.

- There's no fee for transferring securities from another online broker.

- Having a check sent from money in my account is free, but getting statements in the mail cost $2 and mail confirmations are $1.

- All trades cost $7.

TD Ameritrade

(800) 934-4448

- Open an account here that's not a margin account, and you pay nothing.

- To have securities transferred in is also free.

- It's free to have a check sent to you from the money in your account, provided it's to the address on record.

- No minimum balance is necessary.

- It costs $2 to get a statement mailed.

- Trades cost $9.99. But open an account with a minimum of $2,000, and you'll get 30 days of online trading free.

Charles Schwab

(866) 232-9890

- It takes $1,000 to open an account.

* There is no charge to transfer securities in, but it costs $50 to transfer them out.

- It's free to have your statements mailed.

- It's free to have a check from the money in your account sent out.

- Commissions begin at $12.95 and are reduced to $8.95 for those who trade 10 or more times a month.

Fidelity

(800) 343-3548

- For those who only make a few trades per year, it takes $2,500 to open an account.

- Commission costs begin at $19.95 but go down to $8 for very active traders.

- It's free to have a check sent to you or to have statements mailed.

E*Trade

(800) 387-2331

- To move an account from E*Trade, the fee is $60.

- To have a check sent from the money in an account, the charge is $10.

- There is a $2 charge for having account statements mailed.

- There is a $40-per-quarter charge for an account with no trading or bill paying activity.

- A spokesman said E*Trade is looking for ?the active trader.? For infrequent traders, the commission is $12.99; make 30 trades per quarter and each costs $9.99; 150 trades per quarter cost $7.99 each; for 1,500 or more trades per quarter, commissions are $6.99 each.

To read more articles, please visit the column archive.